Decrease in Home Buy Credits and Home loan Renegotiating Rates: An Outline of Latest things

With contract rates reliably declining, numerous property holders are hoping to renegotiate their advances. The Home loan Financiers Affiliation (MBA) detailed a 8 percent expansion in renegotiate applications last week, denoting the fourth sequential seven day stretch of falling rates. The MBA demonstrated that all out contract applications, including renegotiating, rose by 2.4 percent contrasted with the earlier week. The 30-year fixed-rate contract arrived at its absolute bottom since January 2018, dropping from 4.4 percent. Joel Kan, the MBA's Partner VP of Monetary and Industry Estimating, commented that the normal size of renegotiate advances expanded as borrowers with bigger equilibriums benefited from the lower rates.

Alternately, homebuyer reactions to the decreased rates have not been as positive. Applications for home buys declined by 2% soon. The Public Relationship of Real estate agents detailed a 0.4 percent decline in existing home deals last month, demonstrating a second sequential decrease in deals throughout the spring season. Kan noticed that while buy movement fell, it remained around 7% higher than the earlier year. This present circumstance might be impacted by progressing worldwide exchange debates, which have presented vulnerability and impacted generally request. Kan suggested that a few potential purchasers could defer their home quests until there is greater dependability on the lookout.

Moreover, the shortage of reasonable section level homes has prompted expanded costs, delivering them less available for some purchasers. The portion of ensured contract applications through the Government Lodging Organization dropped to 9.4 percent from the earlier week's 10.1 percent.

Alternately, homebuyer reactions to the decreased rates have not been as positive. Applications for home buys declined by 2% soon. The Public Relationship of Real estate agents detailed a 0.4 percent decline in existing home deals last month, demonstrating a second sequential decrease in deals throughout the spring season. Kan noticed that while buy movement fell, it remained around 7% higher than the earlier year. This present circumstance might be impacted by progressing worldwide exchange debates, which have presented vulnerability and impacted generally request. Kan suggested that a few potential purchasers could defer their home quests until there is greater dependability on the lookout.

Moreover, the shortage of reasonable section level homes has prompted expanded costs, delivering them less available for some purchasers. The portion of ensured contract applications through the Government Lodging Organization dropped to 9.4 percent from the earlier week's 10.1 percent.

LATEST POSTS

- 1

ByHeart infant formula recall tied to botulism outbreak puts parents on edge

ByHeart infant formula recall tied to botulism outbreak puts parents on edge - 2

Select Your Definitive Pizza Decision

Select Your Definitive Pizza Decision - 3

Figure out How to Recognize the Right Areas for 5G Pinnacles\

Figure out How to Recognize the Right Areas for 5G Pinnacles\ - 4

Finding the Universe of Computer generated Reality: Individual Encounters

Finding the Universe of Computer generated Reality: Individual Encounters - 5

5 Pizza Fixings That Characterize Your Character

5 Pizza Fixings That Characterize Your Character

Share this article

The German series proving subtitles can be sexy — and wildly addictive

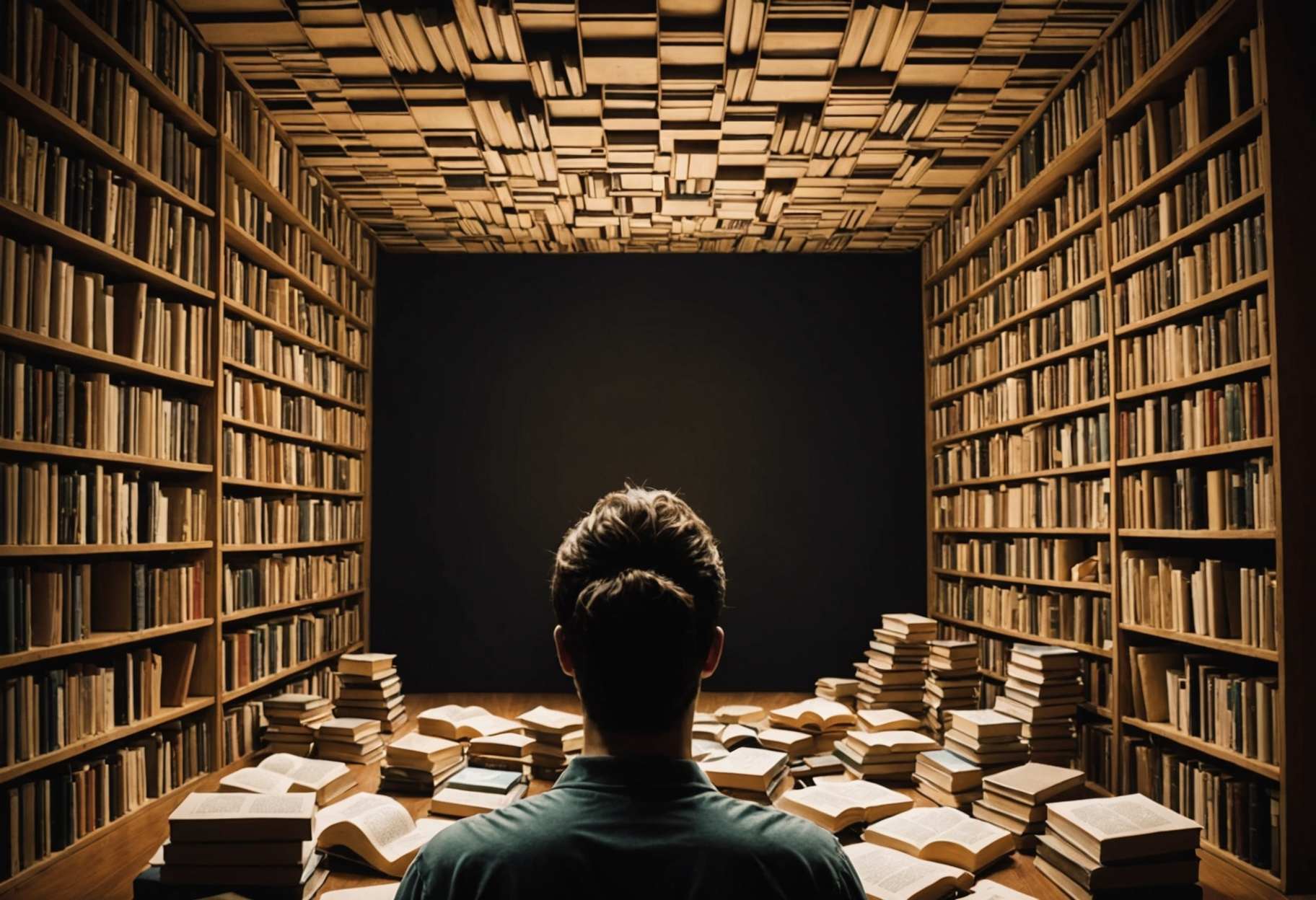

The German series proving subtitles can be sexy — and wildly addictive Top 10 Books That Will Adjust Your Viewpoint

Top 10 Books That Will Adjust Your Viewpoint Worldwide Objections Ideal For A Golf Outing

Worldwide Objections Ideal For A Golf Outing Uncover the Manageable Fish Practices: Sea agreeable Feasting

Uncover the Manageable Fish Practices: Sea agreeable Feasting Astronomers detect black hole blasting winds at incredible speeds

Astronomers detect black hole blasting winds at incredible speeds 3D Printers for Specialists

3D Printers for Specialists US FDA unveils new pathway to approve personalized therapies

US FDA unveils new pathway to approve personalized therapies Find the Lively Food Markets of South America

Find the Lively Food Markets of South America 'The Housemaid' movie with Sydney Sweeney and Amanda Seyfried premieres this month. What the stars have said about the psychological thriller.

'The Housemaid' movie with Sydney Sweeney and Amanda Seyfried premieres this month. What the stars have said about the psychological thriller.